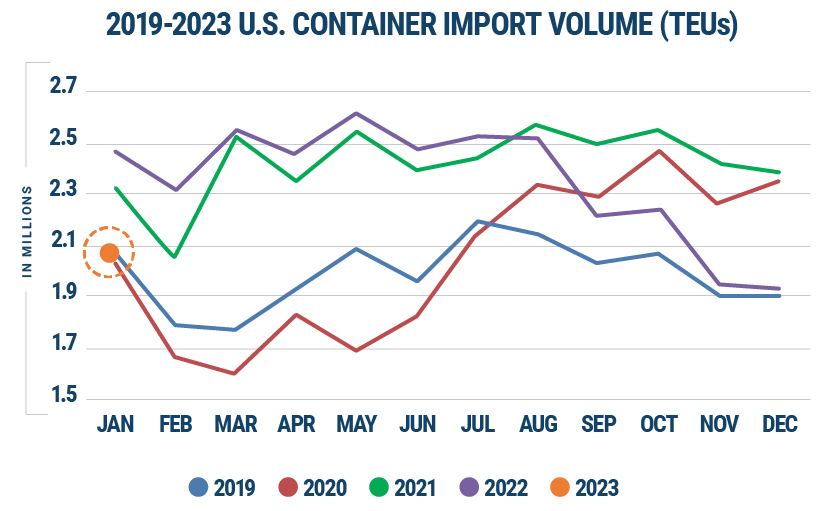

The U.S. line, which began to slump in the second half of last year, is about to pick up?

The latest statistics from Descartes Datamyne, a data analysis group, show that in January 2023, the volume of container imports in the United States ushered in a "good start" and rebounded, with a month-on-month increase of 7.2%. Transport delays at ports on the east coast of the United States also continued to improve.

In more detail, in January 2023, the US container import volume was 2.068 million 20-foot equivalent units (TEU). Although it increased month-on-month, it was still down 16.1% year-on-year compared with January 2022. It was down 0.3 percent in January.

Descartes Datamyne believes in the report that the U.S. economy is a key factor in the growth of container imports. At present, the U.S. economy has shown a stronger macroeconomic performance than expected.

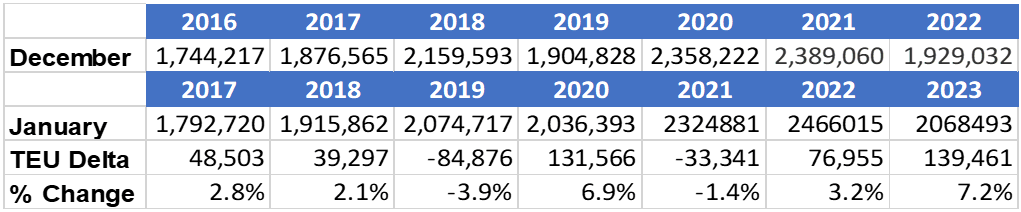

Data source: Descartes Datamyne

Several experts and senior freight forwarders interviewed by China Business News said that looking forward to 2023, the data in the third quarter is more critical. If American retailers are optimistic about the sales prospects in 2023, they will start to replenish goods in large quantities on the basis of "destocking". , usher in a new peak season.

Wang Yong, a professor at the School of International Relations at Peking University and director of the International Political Economy Research Center, believed in an interview with a reporter from China Business News that the US trade volume in the third and fourth quarters of this year will more clearly reflect the US economy and consumption. On the one hand, the U.S. is ushering in a peak holiday season for consumption, and on the other hand, it has a lot to do with economic growth, income levels, and employment at that time.

The recovery trend of the US line is emerging

According to statistics from Descartes Datamyne, U.S. container imports in January 2023 increased by 7.2% compared with December 2022, the largest increase in the past seven years.

Data source: Descartes Datamyne

Specifically, in January 2023, among the top 10 ports in the United States, except for the port of Savannah, all rose month-on-month, and the overall container import volume increased by 107,059. Among them, the total container throughput of the Long Beach Port in California increased. maximum.

Statistics from Descartes Datamyne show that in January 2023, China's exports to the US increased by 11.0% to 762,967TEU, and China accounted for 36.9% of the total US container imports.

Among the top 10 sources of exports to the US, the top five are China, Vietnam, India, South Korea and Thailand.

US containerized imports increased by 106,556 TEU in January 2023, with containers from South Korea showing the fastest month-on-month growth (19.9%), while Germany was the only country in the top 10 to see a decline (-7%).

A stronger-than-expected economy could drive more demand

It can be seen that near the end of 2022, the US import and export data both weakened for a time, but the latest data for December 2022 show that US imports have initially rebounded.

According to data from the US Department of Commerce, in December last year, US imports increased by 1.3% month-on-month to US$317.6 billion. In terms of sub-items, the import of goods increased by 1.8% to 258.8 billion U.S. dollars, reflecting that the U.S. imports were boosted by consumer goods. In addition to mobile phones, imports of other household items also increased. Meanwhile, imports of motor vehicles, parts and engines rose $2.9 billion in the month.

Descartes Datamyne believes that key economic indicators show that the US economy is stronger than expected, which may drive higher import demand in 2023.

U.S. domestic economic figures show that U.S. gross domestic product (GDP) will grow by 2.9% in the fourth quarter of 2022. This is the second consecutive quarter in which the U.S. economy will grow in 2022. Recently, the International Monetary Fund (IMF) released the "World Economic Outlook Report", which raised the global gross domestic product (GDP) growth forecast to 2.9% in 2023, an increase of 0.2 percentage points from the October 2022 forecast. GDP grew by 3.1%. The U.S. GDP growth rate will reach 1.4% and 1.0% this year and next.

According to data released by the U.S. Bureau of Labor Statistics, the number of new non-farm employment in the United States was 517,000 in January, the largest increase since July 2022, nearly three times the market's expected value of 187,000, and the previous value was also revised up to 260,000.

Descartes Datamyne believes in the report that it is necessary to continue to closely observe major economic indicators, such as GDP growth rate, inflation rate, monthly non-agricultural employment report, inventory level and consumer purchasing power.

The reason for this is that a strong economy and consumer buying habits fundamentally affect import demand and US container volumes. For now, the U.S. economy remains more resilient than expected, despite the U.S. government’s attempts to cool it down.

For consumers, investment consulting firm BCA Research said in a report that preliminary results from the University of Michigan's Consumer Sentiment Survey showed that U.S. consumer morale continued to rise, and the assessment index for "status quo" jumped 4.2 points. Moderating price pressures led to improvements in households' assessments of purchasing conditions for large household durables, automobiles, and homes, offsetting the headwinds of higher interest rates and heightened economic uncertainty.

Irene Tunkel, chief strategist of the U.S. Assets Department of BCA Research, told China Business News that since the beginning of this year, stocks in the non-essential consumer goods sector have risen by more than 15%, and this category will fall by about 40% in 2022. %. Shares of smaller companies have also rebounded 22% from their 2022 lows, largely due to reduced headwinds from inflation.

“Small companies with thin margins hate inflation, which not only makes it difficult to budget and plan, but often fails to translate sales growth into earnings growth. Small companies will breathe a sigh of relief as inflation turns,” she said.

Wang Yong believes, “As the Fed continues to raise interest rates aggressively, the U.S. dollar index rises rapidly, resulting in a rapid appreciation of the U.S. dollar relative to the currencies of other countries. Although other countries are also raising interest rates, their national currencies eventually depreciate against the U.S. dollar. The euro This is true for China, the Chinese yuan and the Japanese yen. In this case, the scale of U.S. imports has expanded.”

Looking forward to the import and export situation of the United States in 2023, Wang Yong said that the US economy and consumption will still be affected by the overall macroeconomic trend this year.

However, he also believes that "although the forecasts of economic recession by the IMF and other institutions have improved in the near future, in fact, the US economy may still slow down, which will inevitably affect US import and export trade. In addition, the US inflation rate should increase. Lower it further, and that will also have an impact on imports and exports. Lower inflation itself is a signal of shrinking demand."